Introduction

Sometimes you need to correct invoices, which were already sent to customers. For such situations, Trados Business Managers provides a specific workflow, which allows to quickly adjust sent invoices. There are two ways of making changes in invoices: cancel invoices and issue credit notes.

Cancelling invoices

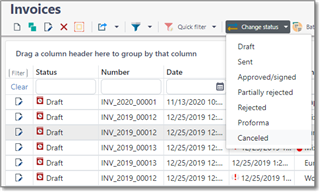

If you don't use e-invoicing functionality, you can simply cancel invoice and issue and new one. To do this, simply select an invoice in the invoice list, then click or hover mouse pointer over Change status button, and select Cancelled.

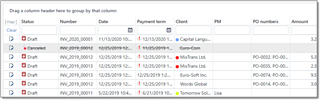

If nothing prevents from cancelling an invoice (for example, invoice has already been partially or fully paid), then invoice status will be changed, which will be reflected in the invoice list (crossed values in a row):

From now, you can simply create a new invoice with correct values.

Credit notes

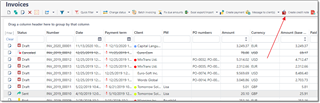

If invoice can't be cancelled or if it is necessary to issue official credit note paper, then you can create a credit note over an existing invoice. Credit notes can be issued over invoices whose status is not one of the following: Proforma, Draft, Cancelled, Credit note. To create credit note, select an invoice and click corresponding button:

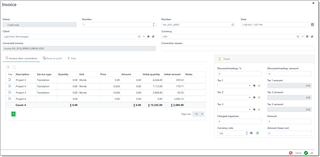

To create a credit note, click corresponding button. In fact, credit note is also an invoice (so you see invoices and credit notes in a single list), but when you open it, instead of Invoice items table you will see Invoice item corrections table. This table contains all items from original invoice, and you can't add or remove records here. It is only possible to change values in the Quantity and Price columns, thus decreasing amount of original invoice item:

By default, when you create a credit note, values in the Quantity column are set to zero. For reference, you can see initial quantities and amounts nearby (Initial quantity and Initial amount columns). If you wish to deduct something from original invoice, just type necessary values in the Quantity and Price column. Resulting amount will give you a credited amount. Then, you can apply same taxes to this amount, as were used in original invoice.

Additionally, you can provide Correction reason in the corresponding field.

For credit notes, a new special invoice template was created. You can find it under Print button:

Use it to preview your credit note:

Credit notes are always created over a single base invoice, which number is mentioned in the Corrected invoice field. When you save a credit note, Due amount of that invoice will be decreased by amount of a credit note. This means that all payments should be registered over original invoice, not over credit note. Sequentially, credit notes won't be available in selection lists when you create payments and choose invoices covered by that payment.

Translate

Translate